Thank you.

Michael D. Hobbs, Jr.

TROUTMAN SANDERS LLP

600 Peachtree Street

Suite 5200

Atlanta, Georgia 30308-2216

(T) 404.885.3330

(F) 404.962.6588

michael.hobbs@troutmansanders.com

From: Haytham Faraj [mailto:haytham@puckettfaraj.com]

Sent: Wednesday, November 02, 2011 11:48 AM

To: Hobbs, Michael D.; McNutt, Steve; Khetan, Prashant K.; Gerstein, Jack; Ross, Stu

Cc: 'Mary Jo'

Subject: RE: ADC offer of settlement--Turrath

Mr. Hobbs,

I feared that Mr. Jandali would view the brief notice as a slight. I can assure you that it was not the intent. I believed that the event was in December as I told Steve yesterday before we got on the phone for the conference. Once I reviewed the flyer, I realized that it was only a few days away. I did not mention your offer because I do not have it. Mr. Ayoub, ADC’s legal director, is on his honeymoon. I, therefore, could not discuss the matter with him. In any event, I appreciate you presenting the offer to Mr. Jandali and understand his response. ADC will continue to seek opportunities to resolve the matter. As for discovery, we will comply with all discovery requests that are consistent with the rules and I am sure you will do the same.

I will reengage on settlement negotiation when Mr. Ayoub returns next week.

Best,

Haytham Faraj, Esq.

PUCKETT & FARAJ, PC

_______________________

WASHINGTON DC METRO

The Law Firm of Puckett & Faraj, PC

1800 Diagonal Road

Suite 210

Alexandria, VA 22314

703-706-0442 Phone

202-280-1039 Fax

DETROIT METRO

The Law Firm of Puckett & Faraj, PC

835 Mason Street

Suite 150-A

Dearborn, MI 48124

313-457-1390 Phone

202-280-1039 Fax

The information contained in this electronic message is confidential, and is intended for the use of the individual or entity named above. If you are not the intended recipient of this message, you are hereby notified that any use, distribution, copying of disclosure of this communication is strictly prohibited. If you received this communication in error, please notify Puckett & Faraj, P.C. at 888-970-0005 or via a return the e-mail to sender. You are required to purge this E-mail immediately without reading or making any copy or distribution.

From: Hobbs, Michael D. [mailto:michael.hobbs@troutmansanders.com]

Sent: Wednesday, November 02, 2011 11:19 AM

To: 'Haytham Faraj'; McNutt, Steve; Khetan, Prashant K.; Gerstein, Jack; Ross, Stu

Cc: 'Mary Jo'

Subject: RE: ADC offer of settlement--Tuurath

Mr. Faraj:

While Mr. Jandali certainly supports the mission of the event, given that it is 8 days from today and considering Mr. Jandali’s schedule, he cannot accept the offer to perform.

In further response to this offer, it needs to be noted that while ADC expresses its desire to resolve this matter:

1) The offer to perform at a event barely a week away, while stated as not offered with disrespect, is difficult to view in any other light;

2) It has made no response to Mr. Jandali’s offer of settlement made nearly 2 months ago.

As we discussed in our phone call yesterday, absent a prompt resolution of this matter, we plan to move forward to serve the ADC with discovery to obtain copies of all internal and external correspondence and related documents regarding the June 2011 ADC National Convention and its unlicensed performance of Mr. Jandali’s work. We trust that you have advised your client regarding its obligations under the federal rules to preserve all electronic and other communications.

Sincerely,

Michael D. Hobbs, Jr.

TROUTMAN SANDERS LLP

600 Peachtree Street

Suite 5200

Atlanta, Georgia 30308-2216

(T) 404.885.3330

(F) 404.962.6588

michael.hobbs@troutmansanders.com

From: Haytham Faraj [mailto:haytham@puckettfaraj.com]

Sent: Tuesday, November 01, 2011 4:26 PM

To: McNutt, Steve; Hobbs, Michael D.; Khetan, Prashant K.; Gerstein, Jack; Ross, Stu

Cc: 'Mary Jo'

Subject: ADC offer of settlement--Tuurath

Gentlemen,

Given the short time that remains before this event. I wanted to get this information to you as quickly as possible. I hope no intent to disrespect Mr. Jandali is imputed to the late notice of this event. It simply was not considered as a possible opportunity until recently.

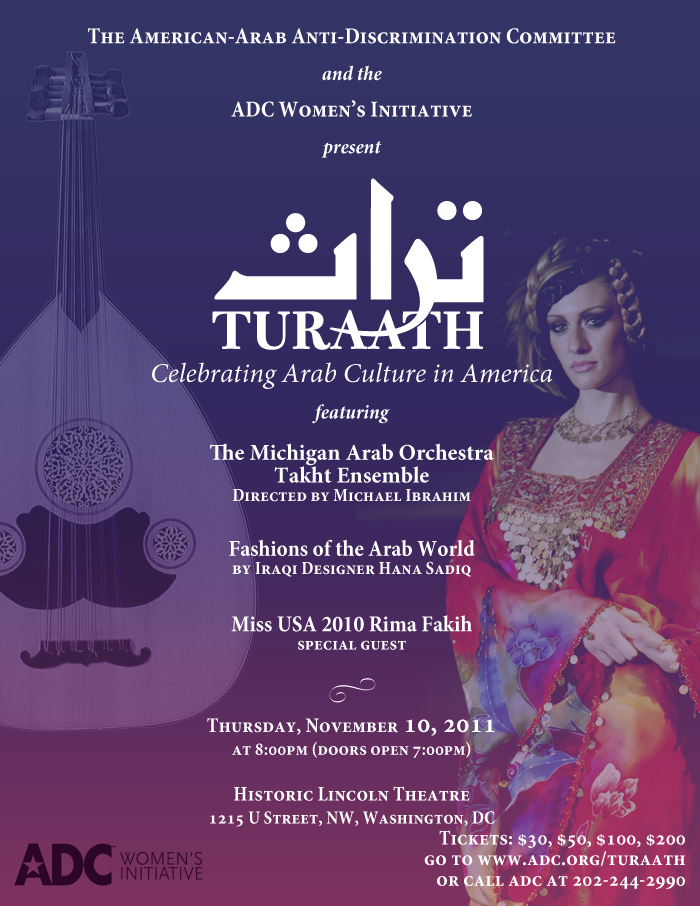

ADC wishes to settle this matter and would like to renew its friendship and goodwill to Mr. Jandali. I have, therefore, been asked to inquire whether Mr. Jandali would accept an invitation to perform at a ADC event celebrating Arab culture. ADC believes this would be an excellent event to make amends because this is an event specifically intended to celebrate culture which would perfectly encompass Mr. Jandali’s music.

The offer would include a portion of the proceeds going to a charity of Mr. Jandali’s choosing and in his name. Please see more about the event below.

Sincerely,

Haytham Faraj, Esq.

PUCKETT & FARAJ, PC

_______________________

WASHINGTON DC METRO

The Law Firm of Puckett & Faraj, PC

1800 Diagonal Road

Suite 210

Alexandria, VA 22314

703-706-0442 Phone

202-280-1039 Fax

DETROIT METRO

The Law Firm of Puckett & Faraj, PC

835 Mason Street

Suite 150-A

Dearborn, MI 48124

313-457-1390 Phone

202-280-1039 Fax

The information contained in this electronic message is confidential, and is intended for the use of the individual or entity named above. If you are not the intended recipient of this message, you are hereby notified that any use, distribution, copying of disclosure of this communication is strictly prohibited. If you received this communication in error, please notify Puckett & Faraj, P.C. at 888-970-0005 or via a return the e-mail to sender. You are required to purge this E-mail immediately without reading or making any copy or distribution.

|

From: McNutt, Steve [mailto:Steven.McNutt@troutmansanders.com]

Sent: Tuesday, November 01, 2011 9:55 AM

To: Haytham@puckettfaraj.com

Cc: Hobbs, Michael D.; Khetan, Prashant K.; Gerstein, Jack; Ross, Stu

Subject: Jandali: Call

Mr. Faraj:

I write to confirm our call at 3:00 p.m. today, as we just discussed. Please use the following call in number (877) 506-4272; passcode (202) 662-2069.

Regards,

Steve

Steven W. McNutt

Troutman Sanders, LLP

401 9th Street, NW

Suite 1000

Washington, DC 20004-2134

Direct Dial: 202.662.2069

Phone: 202.274.2950

Facsimile: 202.654.5833

IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice that may be contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding any penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any transaction(s) or tax-related matter(s) that may be addressed herein.

This e-mail communication (including any attachments) may contain legally privileged and confidential information intended solely for the use of the intended recipient. If you are not the intended recipient, you should immediately stop reading this message and delete it from your system. Any unauthorized reading, distribution, copying or other use of this communication (or its attachments) is strictly prohibited.

IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice that may be contained in this communication (including any attachments) is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding any penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any transaction(s) or tax-related matter(s) that may be addressed herein.

This e-mail communication (including any attachments) may

contain legally privileged and confidential information intended solely for the

use of the intended recipient. If you are not the intended recipient, you should

immediately stop reading this message and delete it from your system. Any

unauthorized reading, distribution, copying or other use of this communication

(or its attachments) is strictly prohibited.